Wilder’s DMI

An important part in the arsenal of any trader dealing with binary options is his directional movement index, and Wilder’s DMI is as good as they come. It was developed by J. Welles Wilder, along with the Relative Strength Index (RSI), and its purpose was determining the strength of a trend along with its direction.

Why is directional movement index even a thing?

Well, every time you consider purchasing a binary option, you need to assess the strength of its price. Strong prices favor bullish strategies while weak prices call for the bearish approach. This also applies on other types of financial products as well. When you combine average DMI values, you get something called the Average Directional Movement Index, or ADX. ADX is important because it shows the strength of a trend.

Well, every time you consider purchasing a binary option, you need to assess the strength of its price. Strong prices favor bullish strategies while weak prices call for the bearish approach. This also applies on other types of financial products as well. When you combine average DMI values, you get something called the Average Directional Movement Index, or ADX. ADX is important because it shows the strength of a trend.

Essentially, you need tools like Wilder’s DMI to tell whether there is a trend or not. And if there is, you need it to tell how strong it is. Needless to say, Wilder’s DMI is extremely popular with traders dealing with other financial product as well, such as futures, stocks, options, commodities etc.

Wilder’s DMI – basic components

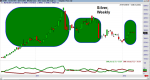

The two basic components of Wilder’s DMI are the Plus Direction Indicator (DI+) and Minus Direction Indicator (DI-). These, along with the Average Directional Index (ADX) are what comprises Wilder’s DMI and makes it work. ADX shows the strength of a trend, while Plus and Minus Direction Indicators show if the price momentum is up or down.

How to use Wilder’s DMI

Reading Wilder’s DMI is not complicated, either. According to Wilder’s instructions, if the ADX is 25 or higher, you have a trend. If the Plus Direction Indicator (DI+) is higher than Minus Direction Indicator (DI -), the trend is going up; if the opposite is true, the trend is going down. This represents the ratio between bullish and bearish positions on the market. The former buy and the latter sell. Just be careful, as trends may reverse at any point, and the Average Directional Index may not necessarily indicate this, as it only focuses on the strength of a trend and not the direction. This is why you should never rely on ADX alone. Always keep a close eye on DI+ and DI- as well. Every now and then, the trend switches, as the buyers take dominance from sellers or vice versa. This is called a crossover and you need to watch out for these – you’ll know it when you see it. You’ll see DI+ and DI- converging in a single point for a moment, before moving on. And while you’re at it, make sure the crossover is not false, as DI+ and DI- meeting may not turn into a trend.

Conclusion

What is all boils down to is the person who interprets the DMI and the way he or she does it. Wilder’s DMI is a great tool, but can only be as effective as the person behind it. Keep that in mind.